Kotak Bank App– Transfer Funds, Pay Bills, Book Train and Flights tickets & more

Use the Kotak Mobile Banking App for digital banking, send and receive money via UPI, book train tickets on IRCTC, flight tickets and hotels on Goibibo. Conveniently pay bills, transfer funds, shop on Flipkart, recharge your mobile or DTH, on-the-go! The Kotak Bank App offers Net Banking, the smart way to monitor your finances easily. Download now!

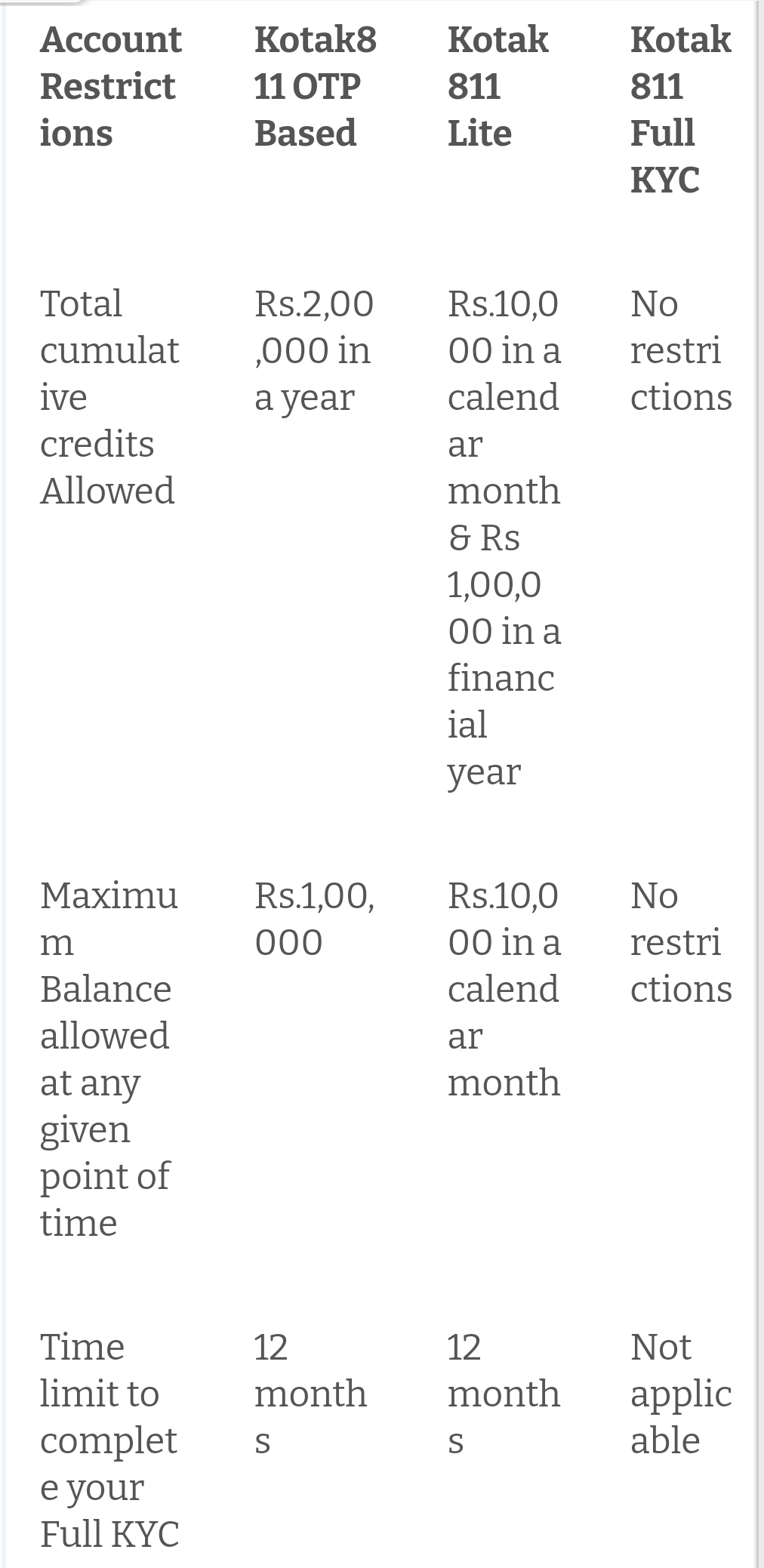

Not a customer yet? Open a Zero Balance Kotak 811 account online!

Use our app to open your very own Kotak 811 savings account. You can open a digital savings account without stepping out of your house and with zero paperwork. Simply submit your Aadhaar number and PAN details to get started. Complete your contactless KYC over a video call!

Your Kotak 811 saving account offers you:

• A zero-balance account

• A free in-app virtual debit card

• Free online fund transfers (UPI, IMPS, NEFT, RTGS)

Online savings account opening has never been so easy!

Internet banking simplified

Experience all the benefits of Net Banking at your fingertips. Here is what you can do with the app:

• Easy access to banking

Manage all your financial transactions from your smartphone. Check your savings account balance, request a chequebook, open a term deposit, and much more.

• Transfer funds

Send and receive funds online through NEFT, IMPS, and RTGS. Transfer funds instantly with BHIM UPI on the Kotak mobile banking App.

• Manage credit/debit cards

Use the app to apply for a credit card, pay bills, regenerate PINs, switch on/off your debit/credit cards and much more.

• Make quick mobile recharges, pay bills, and more

Pay bills anytime, anywhere with the Kotak Mobile Banking app. Recharge your mobile & DTH subscriptions, and pay your utility bills with the handy BillPay feature. You can also set up AutoPay so you never miss a due date again.

• Track investments

Purchase and redeem mutual funds and keep track of your other investments easily.

• Get a personal loan

Avail an instant personal loan starting at ₹3,000 with no documentation and an interest rate as low as ₹1 a day. Use it in case of an emergency or as an advance salary loan.

• Book train tickets and flights

As a Kotak customer, you can even use the app to dive into KayMall to book flights or hotel rooms via Goibibo, buy train tickets via IRCTC, book cabs, or shop on FlipKart.

Experience reliable and fast mobile banking like never before only with Kotak Mahindra 811 & Mobile Banking. Download the app today.

Get started

Signing up on the Kotak – 811 & Mobile Banking App is super simple. Provide your Customer Relationship Number (CRN), debit card/credit card PIN, and Net Banking password. Our app will then take you through a one-time activation process when you login for the first time.

Security

The Kotak – 811 & Mobile Banking App is extremely secure. We value your privacy and account safety and take utmost pride in our digital banking services. Your data will not be shared with any third-party without your consent.

|

Permissions

The Kotak – 811 & Mobile Banking App requires the following permissions from users:

• Contacts: To permit access to mobile numbers for mobile/DTH recharge or sharing IFSC/MMID

• Location: For branch/ATM locator

• Photos/Media/Files/Camera: To access gallery and set images

• Phone: To contact customer service

• SMS: To auto-activate the device during activation process (SMS will be applicable for select customers and is based on customer consent)

ઓફિશ્યલ સાઈટ પર માહિતી અહીંથી જુઓ

અહીંથી જુઓ વિડીયો દ્વારા માહિતી

The Kotak – 811 & Mobile Banking App will access device-level alternate data for credit risk assessment and make decisions for better product offering.

Example: If End of Day Savings Account balance is Rs. 1,50,000, then Rs. 1,00,000 will earn interest of 3.50% p.a. and Rs. 50,000 (being the balance in excess of Rs. 1,00,000), will earn interest of 4.00% p.a.

Can I hold my account jointly with another applicant?

Unfortunately, the Kotak 811 account is intended for a single user only, and cannot be held jointly.

Can I save my application and continue it later

Yes, of course! All the information you’ve entered is regularly backed up to our servers. You may leave the app or close it at any point. When you return, you can resume from where you left off.

How do I start using the Mobile Banking App once my account is activated?

Once your account is active, you can log in to the Mobile Banking App by entering your CRN and the MPIN that you chose during the account opening process.

What's New:

• Sending money to someone just got easy! Introducing ‘Pay Your Contact’ feature on the app. Now send money to your phone contacts irrespective of the payment apps or bank they’re using

• Speed & stability matters, so we have improved it further to give you a better banking experience

No comments:

Post a Comment